These instructions guide a Manager or Administrator, in using the Wurk payroll process to calculate and record of a manual check. You may need to do this when terminating an employee, correcting errors in payment, or providing a bonus.

If you need a physical check printed and mailed from Wurk central offices as a correction or adjustment to a past payroll, this is a different process than the steps below and requires that your or your Administrator contact the Wurk Support team by submitting a Manual Check Shipment Form. If you have questions regarding the form, please reach out to the Support team at support@enjoywurk.com. The purpose of this topic is to guide you in recording a check you have written on your own outside of your normal payroll run, so it incorporates and reports as part of your Wurk payroll. Be aware that live check payments cannot be provided from Wurk same-day and even within 3 business days, they result in extra Wurk fees and tax penalties.

If the employee is paid by direct deposit, this is different than recording a manually written check. See Paying an Employee Manually Via Direct Deposit.

Menu items and on-screen options may vary depending on your configuration and Security Profile.

START HERE

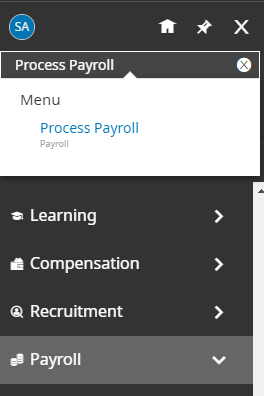

1. From the main (hamburger) menu, enter “Process Payroll” in the Search field and then click on Process Payroll in the search results to go to a list of the payrolls you have access to in Wurk.

2. From the list of payrolls you can see, check that your filters show All Payrolls and scroll to find the next open one. You can use the Date and Status columns to find the next open payroll you can use to generate a manual check. Then click the View/Edit Employee Statements icon next to it. This will enable you to work with the payroll to add the employee’s pay statement for processing.

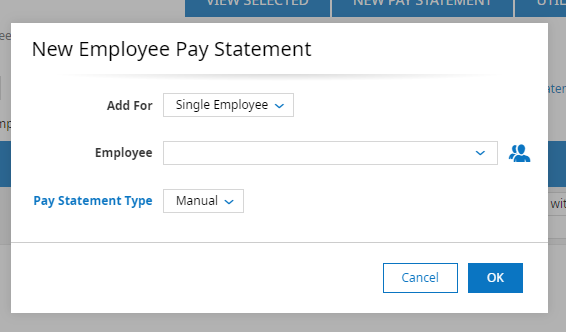

3. From the list view, click NEW PAY STATEMENT to begin creating the manual check record (for recording the payment that will process with your next payroll). You will not, however, generate an actual payment to the employee.

4. In the popup that presents, find the employee by name and set the Pay Statement Type to Manual, then click OK.

5. The next screen lets you manually add earnings and edit the pay statement for the employee.

Add a row each for each of the Earnings you’d like to issue a manual payment for (this is where you enter in the number of hours due to the employee.); then verify and edit any associated scheduled deductions (you can change deductions amounts to zero if they should not be deducted on this pay) and then click SAVE.

| Field Name | Description |

|---|---|

| E/D code | This is the type of pay.

|

| Hours | Hours due to the employee. If you enter hours, do not enter an Amount. |

| Amount | The money the employee is due. If you enter an amount, do not enter hours. |

6. Manually add scheduled earnings and deductions to the pay statement.

Select Add Scheduled Earnings/Deductions (from the UTILITIES button).

Scheduled earning deductions do not automatically pull through on manual pay statements.

7. Apply Changes to return to the Edit Pay Statement page.

8. Then SAVE your entries; this validates them and checks your errors and updates the screen to show calculated taxes, etc.

You can click Preview to see the pay statement as it will appear when finalized, and validate that the pay statement is correct. Then close the Preview and use the Back button to return to the Add/Edit Pay Statements view.

9. Pull in any hours from the employee’s timesheet.

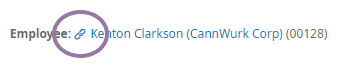

Click the Quick Links icon next to the employee’s name and select Current Timesheet from the button.

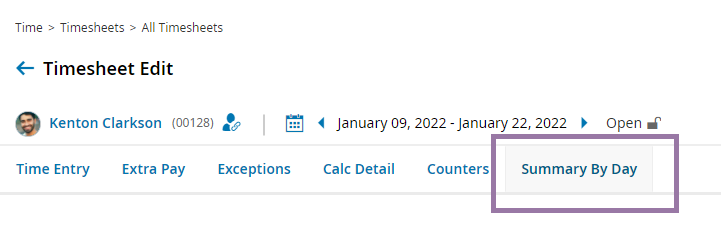

10. Then navigate to the Summary by Day tab, which shows all the earnings that need to pay out.

11. Copy these into the pay statement as a new row. Make sure the E/D Code and E/D name match the type of hours from the timesheet.

12. When all your entries are complete, click SAVE.

Do not modify amounts for FICA or Medicare. These are automatically calculated based on federal rates. If you change these amounts, the employee’s pay will be out of balance.

You have now recorded a manually issued check into your Wurk payroll. For record-keeping, reporting, and tax purposes, be sure not to remove/delete this payroll! You may also wish to open and save the pay statement to send to the employee.