The IRS W4 form was updated in 2020. For more information, see Updated W4 Forms. You do not have to fill out the new form if you already have one on file with your employer, nor do you have to fill out a new form every year. However, if you want to adjust your withholdings at your existing job, you may need to fill out the new W4. Additionally, be aware that some states also require separate state W4 forms.

START HERE

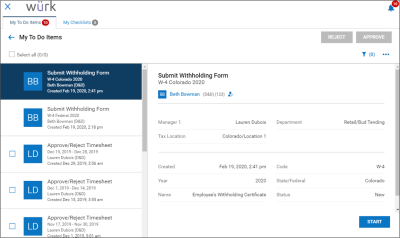

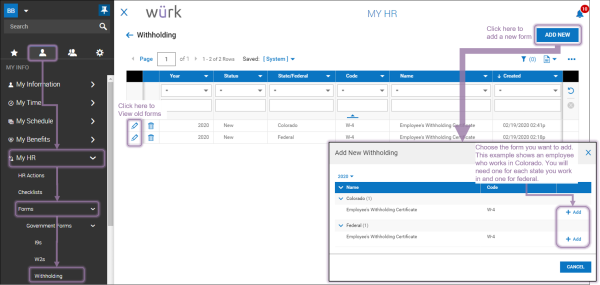

1. When you need to submit a new W4 (for example, when prompted in your My ToDos), you can click through from the To Do item, or from the Main Menu, click My Info>My HR>Forms>Government Forms>Withholding.

If you have not been prompted in the system to provide a W4 and do not see options to complete this form electronically in Wurk, your company may require you to print out a paper form and hand it to your HR department. These forms are available here.

OR

Submitted forms cannot be editted. To make a change, a new one must be added.

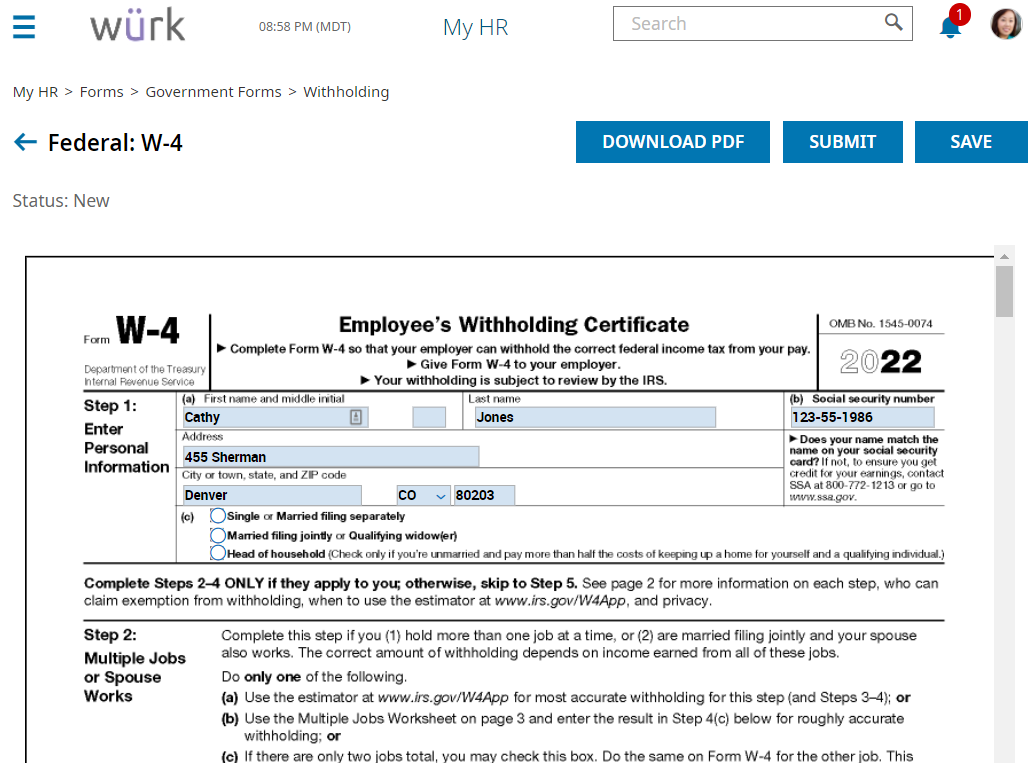

2. Complete the form.

For guidance, see Understanding the W4 Form. Also, we recommend that you contact your HR department or research online, for example, see this IRS guide to the Form W-4, and these tips.

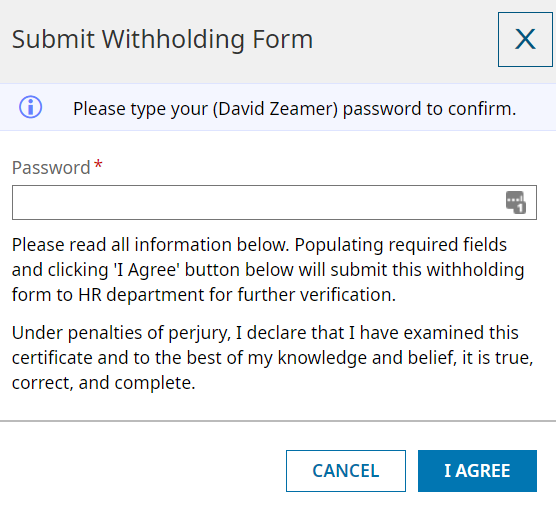

3. When you complete and submit the form, a window will pop up for you to enter your password. This will serve as your signature on the form.

4. Click the I AGREE button to complete the submission.

Your HR department will be automatically notified of your form submission and the ToDo item will be complete.