Retirement Planning

The Wür(k) Retirement Plan offers a fully scalable, transparent, & compliant 401(k) solution to the cannabis industry.

With more and more states introducing 401(k) mandates, Würk wanted to make finding a plan for cannabis companies easy. Our multiple employer 401(k) plan lowers costs and creates less hassle while leveraging the same design flexibility you’re used to. The result? Better outcomes for your employees.

What is the Wür(k) Retirement Plan?

A fully scalable and compliant 401(k) solution for the cannabis industry.

With more and more states implementing 401(k) mandates for companies, Würk wanted to give an easy, scalable, and compliant solution to our cannabis clients. The Würk Retirement Plan is a multiple employer 401(k) plan with a 360 payroll integration between the Würk system and the 401(k) platform. The Würk Retirement Plan uses ACH to automatically pull all contributions to your plan instead of having to manually wire funds.

With full investment advisory and management fiduciary protection by intellicents investment solutions, inc., acting as a 3(21) and 3(38) advisor, a dedicated support team, and no annual audit, the Würk Retirement Plan enables cannabis companies to offer robust retirement options for their employees.

Why Choose the Wür(k) Retirement Plan?

Attract & retain talent by offering a compliant retirement option.

Employees are a company’s greatest assets, and the cannabis industry is no exception. With so many states mandating 401(k) retirement solutions, companies can no longer afford to not offer this benefit to their employees.

Wurk’s multiple employer retirement plan is a compliant, easy, and scalable solution that can actually save your company money over other retirement solutions.

Wurk’s Retirement Plan gives your employees access to:

- A fiduciary advisor to help them with their financial needs

- A dedicated support team to help with any issues

- 24/7 online access and mobile app

- Participant education and advice

- A managed account solution that gives participants a personalized investment allocation.

The Würk Retirement Plan is the perfect solution for cannabis companies wanting to attract top talent with quality benefits.

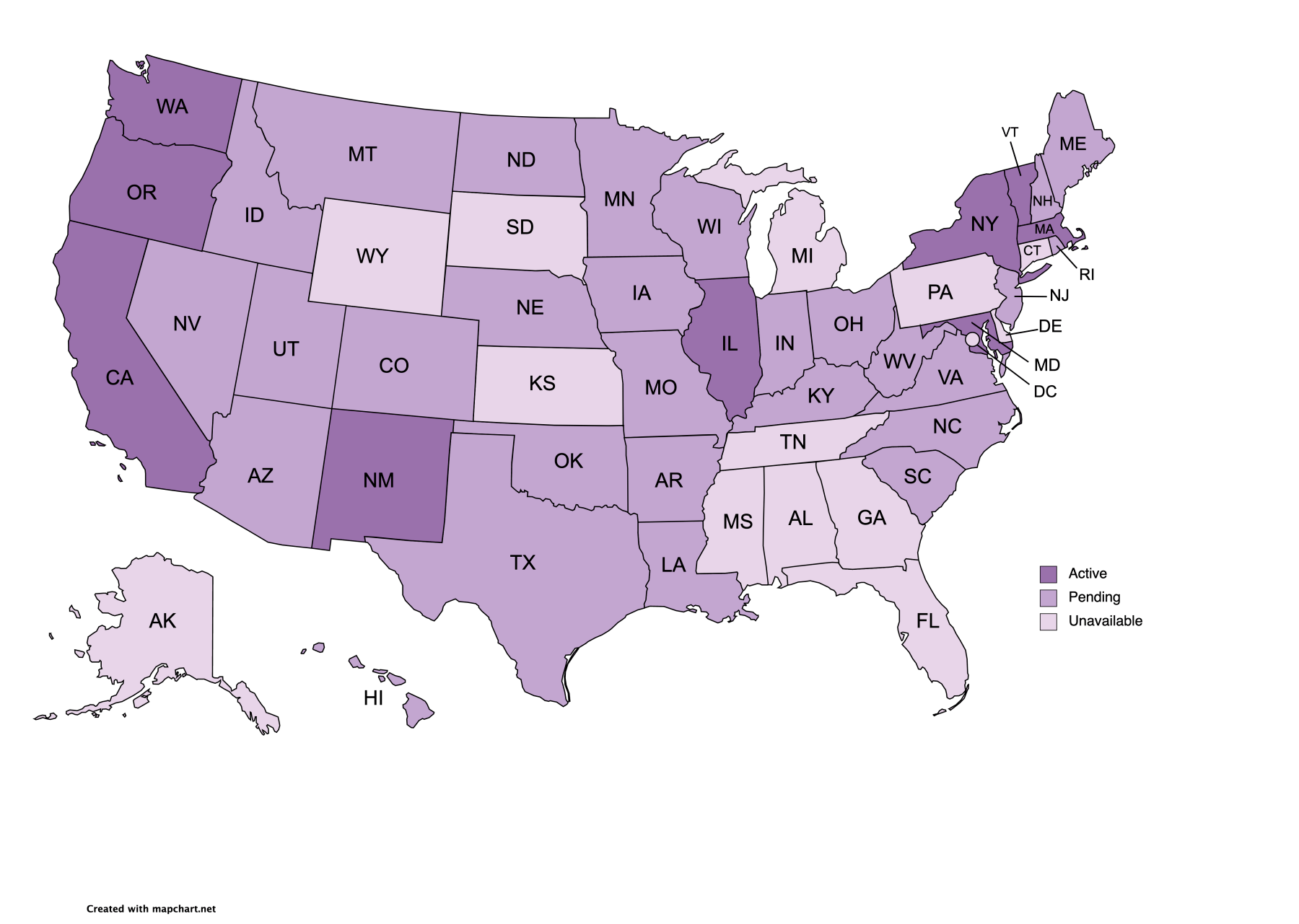

401(k) Mandates

States are beginning to adopt 401(k) mandates

Right now there is a huge push to get more Americans access to retirement savings plans. Currently, 13 states have passed some sort of 401(k) legislation, and that number is only expected to grow, with most other states considering adopting legislation.

More and more cannabis employers are starting to look at adding enhanced benefits for employee attraction and retention. In addition, cannabis companies are expected to comply with these state mandates, despite the fact that many mainstream 401(k) providers are still not willing to enter the cannabis space.

What is a MEP?

MEP stands for multiple employer plan.

A multiple employer plan (MEP) is an employee benefit offered by two or more unrelated employers. It is designed to encourage businesses to share the administrative burden of offering a tax-advantaged retirement savings plan to their employees.

Administrative and fiduciary responsibilities of the MEP are performed by a sponsor, which may be an employer, a trade group, or a third party.

Single Employer Plan vs. Multiple Employer Plan

Single Employer Plan

- Company sponsors plan and must maintain own plan document

- 1 Form 5500 and audit per single plan

- Employer must maintain fiduciary file, conduct due diligence on providers, and provide all necessary disclosures

- Employer can choose investment menu

- Investment qualification based on single plan assets

- Fees based on single employer breakpoints

Multiple Employer Plan

- Company adopts already established plan that is maintained by the Sponsor

- 1 Form 5500 and audit per MEP

- Sponsor maintains fiduciary file, conducts due diligence on providers, and provides all necessary disclosures

- Advisor on MEP builds fund list for all adopting employers

- Investment qualification based on total MEP assets

- Fees based on total MEP assets/participant breakpoints

- Complete plan design flexibility

- Eligibility

- Employer contributions

- Safe Harbor provisions

- Distribution options

- Non-discrimination testing per plan

- Dedicated support from your providers

- Great mobile and online applications

Case Study

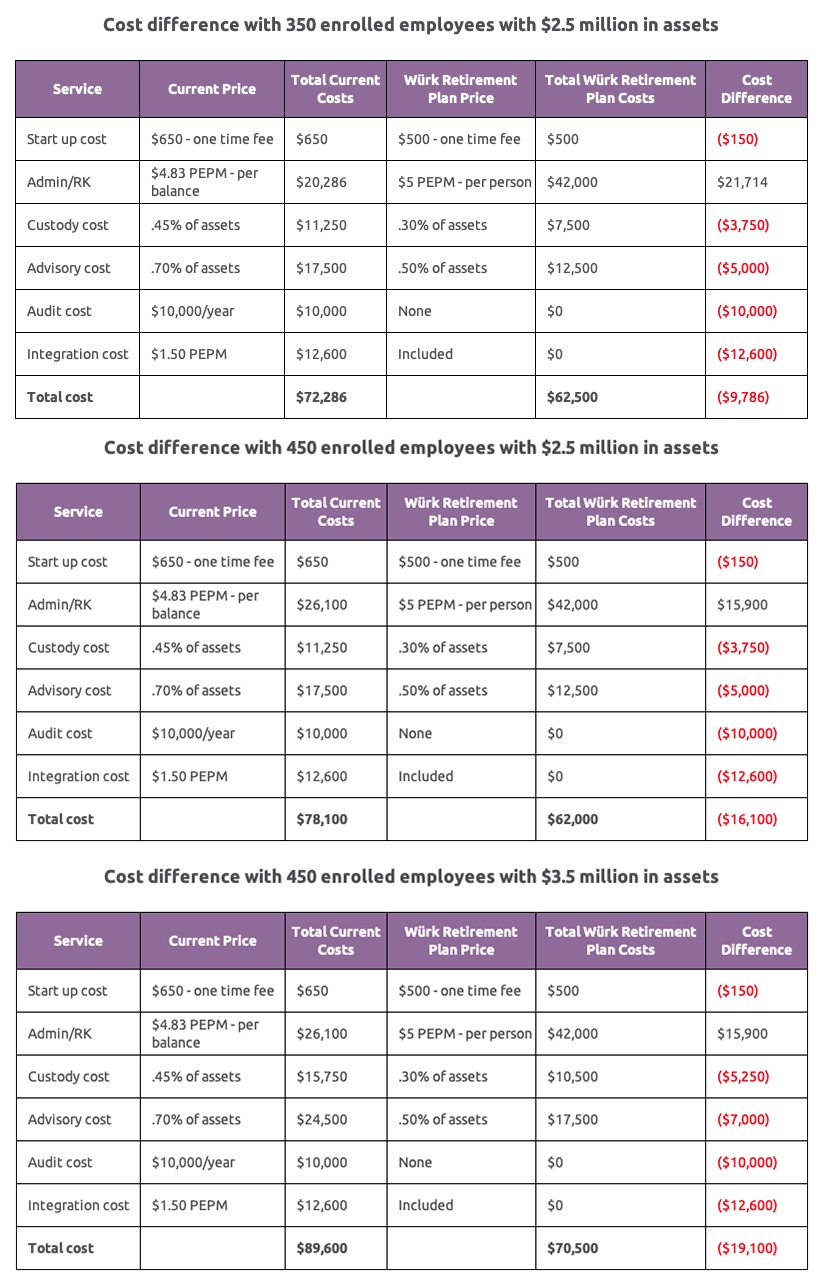

Let’s take a look at an example of differences in cost.

In this example, we are going to look at the difference in costs for a multi-state operator (MSO) with 700 employees, and who currently has a single employer 401(k) plan. This company has a payroll integration with Würk for $1.5 PEPM.

In the first example, we used the following scenario:

- 350 employees are participating in the plan

- $2.5 million in assets

In the second example, we used the following scenario:

- 450 employees are participating in the plan

- $2.5 million in assets

In the third example, we used the following scenario:

- 450 employees are participating in the plan

- $3.5 million in assets

*For illustrative purposes only. Contact your Customer Success Manager for actual costs.